Machinery Loan for MSME – Easy Money for Buying and Upgrading Machines

A machinery loan for MSME is a simple loan that helps small and medium businesses buy new machines or upgrade old ones. Many MSMEs need better equipment to make products faster, improve quality, or increase their daily work capacity. With an MSME machinery loan, a business can get the machines it needs without paying the full amount at once.

This type of loan is useful for factories, workshops, small units, and service businesses that depend on machines for daily work. An equipment loan for MSME gives the money first, and the business repays it in easy monthly steps. It makes growth easier and helps the business work with better tools.

What is a Machinery Loan for MSME?

Apply For MSME Loan Now

A machinery loan for MSME is a special loan that helps a business buy new machines or upgrade old equipment. Machines are important for any small or medium business because they increase speed, improve quality, and help complete more work in less time. But buying machines can be expensive, so an MSME machinery loan gives the money needed to make this process easier.

This type of loan is also known as equipment loan for MSME or MSME equipment finance. The business gets a fixed loan amount and repays it slowly in simple monthly EMIs. Many MSMEs use this loan when they want to expand their factory, improve production, or start a new unit.

Simple Example :

If a small manufacturing unit wants to buy a new cutting machine but cannot pay the full amount right now, a machinery loan helps them buy the machine today and repay the money over time.

This makes a machinery loan for MSME a smart and practical choice for businesses that depend on good machines to grow.

Key Features of MSME Machinery Loan

A machinery loan for MSME comes with simple and helpful features that make it easy for businesses to buy or upgrade machines. These features support small and medium businesses that need better tools to grow.

Recent Posts

Fixed Loan Amount : An MSME machinery loan gives a fixed loan amount based on the cost of the machine you want to buy. This helps you plan your purchase properly.

Easy Monthly EMIs : The loan is repaid in small and simple EMIs. This makes the equipment loan for MSME easy to manage, even for a small business.

Supports New and Old Machinery : The loan can be used for buying brand-new machines or upgrading old equipment. Many MSMEs use MSME equipment finance to improve their production setup.

Long Repayment Tenure : You get enough time to repay the loan. This reduces pressure and helps the business handle its daily expenses comfortably.

Useful for Many Industries : Manufacturing units, workshops, factories, and service businesses can use a machinery loan for MSME to increase their work ability and improve performance.

Simple Documentation : The documents needed are basic and easy to provide, so the process stays smooth for small businesses.

Benefits of Machinery Loan for MSME

A machinery loan for MSME gives strong support to businesses that depend on machines for production and daily work. It helps MSMEs grow faster and work better without putting too much pressure on their budget.

Helps Buy New Machines : Many small businesses cannot pay the full price of a machine at once. An MSME machinery loan gives the needed money so the business can buy the machine immediately and repay later.

Upgrade Old Equipment Easily : Old machines work slowly and reduce product quality. With MSME equipment finance, a business can upgrade to better and faster machines.

Improves Production Speed : Better machines help finish work faster. This increases output and helps the business complete more orders in less time.

Better Product Quality : New or upgraded equipment improves accuracy and quality. This makes your customers happier and builds trust.

Supports Business Growth : A machinery loan for MSME helps the business take bigger orders, increase capacity, and move to the next level of growth.

Reduces Financial Stress : Instead of paying a large amount at once, the business pays small EMIs. This keeps daily expenses smooth and stress-free.

Who Can Apply for an MSME Machinery Loan?

A machinery loan for MSME is made for many types of small and medium businesses. Any business that uses machines or equipment in daily work can apply for this loan. The rules are simple, so even new MSMEs can apply if they have basic documents.

Manufacturing Units : Factories and small production units that need machines to make products can apply. Many use an MSME machinery loan to increase production.

Workshops and Small Industries : Units like welding shops, printing shops, fabrication units, and repair workshops often need new equipment. A machinery loan for MSME makes it easy to upgrade.

Service Businesses Using Equipment : Businesses like salons, clinics, repair centers, or small labs use equipment for daily work. They can apply for MSME equipment finance to buy or upgrade tools.

Traders Who Sell Machines : Some traders also take machinery loans to buy stock or machines for resale.

New MSMEs Setting Up a Unit : A new business planning to set up a factory or workshop can apply for an equipment loan for MSME with simple documents and a basic plan.

Businesses Expanding Their Capacity : If your business wants to take bigger orders or handle more work, this loan helps you buy machines that support faster growth.

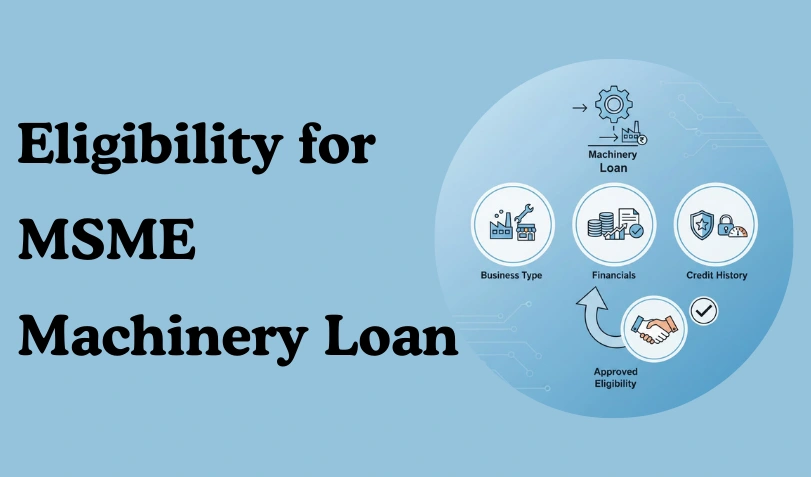

Eligibility for MSME Machinery Loan

The eligibility rules for a machinery loan for MSME are easy to understand. These points help the lender check if your business can repay the loan and use the machine correctly. Most small and medium businesses qualify if they meet the basic requirements.

Business Age and Stability : Your business should be running for at least 1 year. A stable business has a higher chance of getting an MSME machinery loan.

Regular Income or Cash Flow : The business should show steady sales or regular cash flow. This helps the lender decide the right loan amount for MSME equipment finance.

Clear Bank Statements : Banks check the last 6–12 months of bank statements. Clean statements make it easier to get a machinery loan for MSME.

Valid Business Registration : You need Udyam Registration, GST details, or any legal business document to apply for an equipment loan for MSME.

Basic Financial Documents : ITR, GST returns, or simple financial papers help the lender understand your income and repayment ability.

Credit Behaviour : A good credit record increases approval chances. Even if the score is average, many MSMEs get approval if other documents are strong.

Machinery Details : For some loans, you may need to share the machine quotation or basic details about the equipment you want to buy.

Documents Required for MSME Machinery Loan

To apply for a machinery loan for MSME, you need a few simple documents. These papers help the lender understand your business, your income, and the type of machine you want to buy. Most MSMEs already have these documents, so the process becomes easy.

Identity Proof : Aadhaar Card or PAN Card of the business owner.

Business Registration Papers : Udyam Registration, GST registration, shop license, or any document that proves your business is legal and active.

Address Proof : Electricity bill, rent agreement, or any document showing your business or office address.

Bank Statements (6–12 months) : Clean bank statements help the lender check your cash flow. This is important for approving an MSME machinery loan.

GST Returns / ITR : These documents show your income pattern and help the lender decide the right amount for MSME equipment finance.

Financial Documents : Simple financial papers like turnover proof, profit and loss details, or balance sheet (if available).

Machinery Quotation : A quotation or price estimate of the machine you want to buy. This helps the lender understand how much loan you need for the machinery loan for MSME.

Purchase Invoice (If Already Selected) : If you have already chosen the machine, you can provide the invoice or product details.

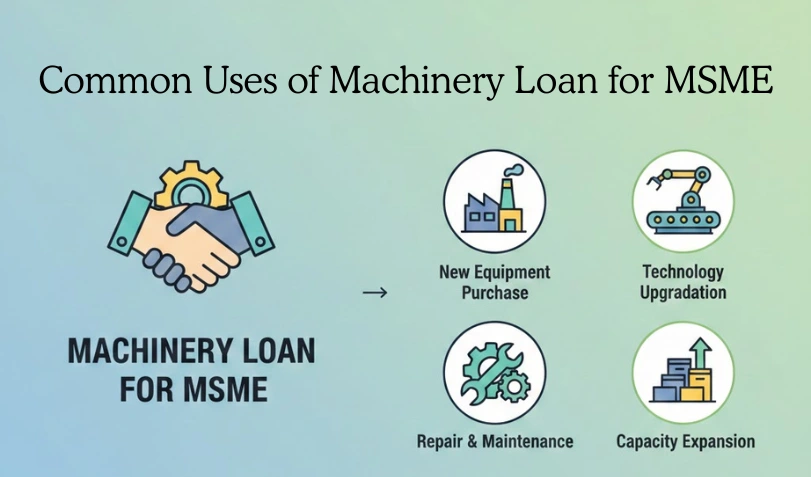

Common Uses of Machinery Loan for MSME

A machinery loan for MSME can be used for many important business needs. It helps MSMEs buy new machines, improve old equipment, and increase their production capacity. Here are some common and practical uses:

Buying New Machinery : Many small factories and workshops use an MSME machinery loan to buy new machines that help them work faster and produce better results.

Upgrading Old Equipment : Old machines slow down work. With MSME equipment finance, a business can replace old tools with modern and more efficient machines.

Automation and Technology Upgrade : Businesses that want to move from manual work to automated systems use a machinery loan for MSME to buy advanced machines.

Setting Up a New Unit : New factories and workshops often need machines to start production. An equipment loan for MSME gives the money needed for a strong setup.

Increasing Production Capacity : If the business wants to take larger orders or grow faster, buying extra machines becomes important. Machinery loans support this expansion easily.

Buying Industrial Machines : MSMEs use the loan to buy machines like CNC machines, lathe machines, drilling machines, packaging machines, printing machines, and other industrial tools.

Repair and Replacement : Sometimes machines break down or become unsafe. A machinery loan helps repair or replace them without affecting daily work.

Machinery Loan Interest Rates & Charges

The interest rate for a machinery loan for MSME depends on the business profile, documents, and type of machine being purchased. Every MSME has different needs, so the rate is not the same for all. Still, most businesses get simple and manageable rates that make machine purchase or upgrade easy.

What Affects the Interest Rate?

1. Business Stability : If your business has steady income and regular work, lenders may offer better rates for an MSME machinery loan.

2. Bank Statements & Cash Flow : Clean and stable bank statements show strong financial health. This helps lenders offer the right amount for MSME equipment finance.

3. Credit Score : A higher credit score often brings a lower interest rate. Even if the score is average, MSMEs can still get approval if other documents are strong.

4. Machine Type and Cost : Some machines are high-value or advanced. The interest rate may change depending on the cost and purpose of the equipment.

5. Loan Amount & Tenure : A bigger loan or a longer repayment period may slightly affect the rate. Lenders decide based on the business’s repayment ability.

Other Possible Charges : A machinery loan may also include:

- Processing fee

- Documentation charges

- EMI delay charges

- Prepayment or foreclosure charges (depending on lender rules)

All charges are explained clearly before approval, so the MSME knows exactly what to expect from the machinery loan for MSME.

How to Apply for a Machinery Loan for MSME

Applying for a machinery loan for MSME is simple. Most small and medium businesses can complete the process with basic documents and a clear plan for the machine they want to buy. Here are the easy steps:

1. Check Your Eligibility : Make sure your business meets the basic rules for an MSME machinery loan. This includes business age, steady income, and clean bank statements.

2. Collect Your Documents : Keep your ID proof, business papers, bank statements, and GST/ITR ready. These documents help the lender understand your profile and offer the right amount for MSME equipment finance.

3. Choose the Machine You Want to Buy : Every machinery loan needs a clear purpose. Select the machine, get a quotation, and decide how much loan you need for your business.

4. Submit the Loan Application : You can apply online or offline. Online applications save time and make the process simple for small businesses.

5. Verification by the Lender : The lender checks your documents, business turnover, cash flow, and the machine details. This helps them confirm if the machinery loan for MSME is the right fit.

6. Loan Approval and Disbursement : After verification, the loan gets approved, and the money is sent to your account or directly to the machine seller. You can then buy the machine and start using it for your business.

If you want simple guidance and easy-to-understand information about MSME loans, you can visit msmeloaninindia.co.in.

The website explains machinery loans and other MSME loan options in clear, simple language.

Machinery Loan vs Equipment Finance – What’s the Difference?

Many people think a machinery loan for MSME and equipment finance are the same, but there is a small difference. Both loans help businesses buy tools and machines, but their purpose and structure can be slightly different.

Machinery Loan for MSME : A machinery loan is mainly used for buying big or important machines. It helps with:

- New machine purchase

- Machinery upgrade

- Setting up production units

- Increasing factory capacity

It is usually a fixed loan amount with monthly EMIs.

Equipment Finance : MSME equipment finance covers both machines and smaller tools. It helps with:

- Small equipment

- Tools

- Technology upgrades

- Replacing old or broken equipment

It can be flexible and may cover a wider range of items.

Simple Comparison Table : Machinery Loan vs Equipment Finance

| Point | Machinery Loan for MSME | Equipment Finance |

|---|---|---|

| Purpose | Big machines | Machines + tools |

| Loan Type | Fixed EMI loan | EMI or flexible options |

| Best For | Manufacturing units | Small & medium MSMEs |

| Usage | Expansion & production | Daily equipment needs |

Which One Should You Choose?

If your business needs a major machine or wants to expand production, a machinery loan for MSME is best. If you need tools or smaller equipment, MSME equipment finance may be more suitable.

FAQs – Machinery Loan for MSME

What is a machinery loan for MSME?

Who can apply for an MSME machinery loan?

Can I buy any type of machine with this loan?

Do I need collateral for a machinery loan?

What documents are needed for an MSME machinery loan?

How long does it take to get the loan?

Can new businesses get a machinery loan?

Where can I find simple information about MSME machinery loans?

Final Thoughts on Machinery Loan for MSME

A machinery loan for MSME is one of the easiest ways for a small or medium business to buy new machines or upgrade old ones. Machines help a business work faster, improve quality, and take larger orders. With an MSME machinery loan, a business gets the money it needs now and repays it in small EMIs over time. This makes growth easier and reduces financial pressure.

Whether your business is a small factory, workshop, service unit, or a new MSME setting up operations, the loan supports important tasks like production, expansion, and technology upgrades. Many businesses also use MSME equipment finance to replace old tools and keep their work smooth.

If you want simple guidance about MSME loans, you can visit msmeloaninindia.co.in. The website explains machinery loans and other MSME loan options in clear, easy language.

With the right machinery loan, your MSME can work smarter, grow faster, and build a stronger future.

Apply For MSME Loan Now

Recent Posts

Contact Us

1204 GD – ITL Building, B- 08,

Netaji Subhash Place, Delhi-110034

Email: ceo@nkbkredit.com

Phone: +91 7503211000,

+91 9654981031

Important Links

Disclaimer

This website functions as a MSME-specific advisory channel supporting businesses seeking structured funding solutions. Advisory, documentation, and lender coordination services are provided by NKB Kredit Solutions Pvt. Ltd., a registered Indian company offering business finance advisory services.