Working Capital Loan for MSME – Simple Money for Daily Business Needs

A working capital loan for MSME is a short-term loan that helps a business manage its daily expenses. Every small or medium business needs money to buy raw materials, pay suppliers, handle bills, or manage cash flow when customer payments get delayed. An MSME working capital loan gives fast and flexible support so the business can run smoothly without stopping.

This type of loan is not for buying big machines or opening a new unit. It is mainly used to keep daily work going. That is why many traders, shop owners, and manufacturers choose working capital finance for MSME when they need quick money for regular business needs.

What is a Working Capital Loan for MSME?

Apply For MSME Loan Now

A working capital loan for MSME is a short-term loan that helps a business manage its everyday activities. It is mainly used to cover small but important expenses that keep the business running. These expenses may include raw materials, stock, salary, transport, or supplier payments.

Unlike long-term loans, an MSME working capital loan is not used for big projects. It is meant for quick money needs that come again and again. Many businesses face cash flow gaps when customers pay late or when demand suddenly increases. In such moments, working capital finance for MSME gives the business the money it needs to continue work without slowing down.

A simple example: If a shop owner has to buy new stock but payments from old customers are delayed, this loan helps fill the gap. Once the customer pays, the business repays the loan. This makes the working capital loan for MSME a very important tool for smooth daily operations.

Key Features of Working Capital Loan for MSME

An MSME working capital loan is designed to help a business handle its daily money needs. It comes with simple and flexible features that make it easy for small and medium businesses to use. MSMEs are mainly divided into three groups:

Flexible Usage : A working capital loan for MSME can be used for many daily needs like buying raw materials, paying bills, or handling short-term expenses. There are no strict rules on how to use the money.

Recent Posts

No Fixed EMI (For CC or OD) : In limits like MSME cash credit loan or overdraft facility for MSME, you do not pay a fixed EMI. You pay interest only on the amount you use, which keeps the cost low.

Use, Repay, and Use Again : With cash credit or overdraft, you can withdraw money whenever you need it and repay when your cash flow improves. This helps manage ups and downs in the business easily.

Supports Daily Cash Flow : An MSME working capital loan is mainly for day-to-day operations. It helps the business run smoothly even when customer payments come late.

Short-Term Financial Support : This loan works like a safety net. It gives quick help during busy seasons, high-demand periods, or sudden expenses that the business must handle immediately.

Easy to Understand and Manage : The loan process is simple, and the rules are easy. Even a small trader or shop owner can manage working capital finance for MSME without confusion.

Benefits of MSME Working Capital Loan

A working capital loan for MSME gives quick and steady support for daily business needs. It helps the business stay active, stable, and ready for busy days. Here are some simple and clear benefits:

Helps in Daily Operations : This loan gives money for everyday tasks like paying bills, buying stock, or handling small expenses. It keeps the business running even when cash is low.

Smooth Cash Flow : Many MSMEs face cash flow gaps when customers pay late. An MSME working capital loan fills this gap so the business does not stop or slow down.

Buy Raw Materials on Time : Manufacturers and shop owners can buy raw materials or new stock without waiting for old payments. This helps them complete orders faster.

Business loan type

Pay Suppliers Without Delay : Timely supplier payments help the business maintain good relationships. A working capital finance for MSME ensures you never miss important payments.

Support During Busy Seasons : Some businesses need extra money during festival seasons or high-demand periods. This loan helps them handle extra orders with confidence.

Reduces Financial Stress : Short-term money problems can create pressure. A working capital loan gives quick support, which reduces stress and helps the owner focus on growth.

Useful for Traders, Shops, and Small Units : Whether you own a shop, a small factory, or a service business, an MSME working capital loan helps manage day-to-day operations smoothly.

Who Needs a Working Capital Loan for MSME?

A working capital loan for MSME is helpful for many types of small and medium businesses. Any business that deals with daily expenses, slow customer payments, or sudden money needs can use this loan. It gives quick support so the business does not stop.

Manufacturers : Factories and small units often need money to buy raw materials, pay workers, or handle production costs. An MSME working capital loan helps them complete orders on time.

Retail Shops & Traders : Shops and trading businesses need regular stock. When payments are delayed, working capital finance for MSME helps them buy new stock without waiting.

Service-Based Businesses : Salons, clinics, repair centers, coaching institutes, and other service businesses use the loan to handle rent, salaries, and monthly expenses.

Wholesalers & Distributors : They deal with large orders and need money to maintain inventory. A working capital loan for MSME keeps their supply chain moving smoothly.

Seasonal Businesses : Businesses that earn more during festivals or peak seasons need extra money for short periods. An MSME working capital loan helps them handle the rush.

Businesses Facing Cash Flow Gaps : Any MSME that receives payments late or in parts needs this loan to keep operations running day-to-day.

Eligibility for MSME Working Capital Loan

The eligibility rules for a working capital loan for MSME are simple. These points help the lender understand if your business can handle the loan and repay it on time. Most small and medium businesses can qualify if they meet the basic requirements.

Business Age and Stability : The business should be running for at least 1 year. A stable business has a better chance of getting an MSME working capital loan.

Regular Cash Flow : Banks check your income pattern. If your business has regular sales or steady deposits, it becomes easier to get working capital finance for MSME.

Clear Bank Statements : Your last 6–12 months’ bank statements should be clean. Good cash movement helps the lender offer the right limit.

Valid Business Registration : You need Udyam Registration, GST details, or any legal business document to apply for a working capital loan for MSME.

Good Credit Behaviour : A good credit score increases approval chances. But many MSMEs with average scores also qualify if their documents and business performance are strong.

Basic Financial Documents : ITR, GST returns, or simple financial statements help show your income level. Lenders use these to decide your working capital limit.

Documents Required for MSME Working Capital Loan

To get a working capital loan for MSME, you only need a few basic documents. These papers help the lender understand your business, your cash flow, and your ability to repay the loan. Most MSMEs already have these documents ready, so the process becomes easy.

Identity Proof : Aadhaar Card or PAN Card of the business owner.

Business Registration Papers : Udyam Registration, GST registration, shop license, or any valid proof that your business is legally active.

Address Proof : Electricity bill, rent agreement, or any document showing your business or office address.

Bank Statements : Last 6 to 12 months of bank statements. These statements help the lender check your cash flow, which is very important for an MSME working capital loan.

GST Returns / ITR : Simple tax documents like GST returns or ITRs show your income pattern. They help the lender decide your working capital finance for MSME limit.

Financial Documents : Basic financial papers such as a profit and loss statement, turnover proof, or balance sheet (if available). Small businesses can also provide simple income proof.

Stock or Raw Material Details (If Needed) : Some lenders may ask for stock or purchase details, especially if the working capital loan for MSME is used for buying raw materials or inventory.

How Working Capital Loan for MSME Works

A working capital loan for MSME works in a very easy way. It gives your business quick money for daily needs and helps you handle cash flow without stress. There are mainly three common ways this loan works.

1. Cash Credit (CC) : In an MSME cash credit loan, the bank gives you a limit. You can:

- Withdraw money whenever you need

- Repay when you get customer payments

- Use the limit again

You pay interest only on the amount you use. This helps manage ups and downs in cash flow.

2. Overdraft Facility (OD) : The overdraft facility for MSME also gives a flexible limit. You can spend more than your account balance up to a set limit. It is useful when you need quick money for payments or stock.

3. Short-Term Working Capital Loan : This is a simple loan with a fixed amount and short repayment time. Many small MSMEs use it when they need fast support for daily work or sudden expenses.

Simple Example : If a shop owner needs ₹1 lakh to buy new stock but customers will pay after 20 days, an MSME working capital loan fills the gap. Once payments come, the loan is repaid easily.

These options make working capital finance for MSME a flexible and helpful tool for managing everyday business needs.

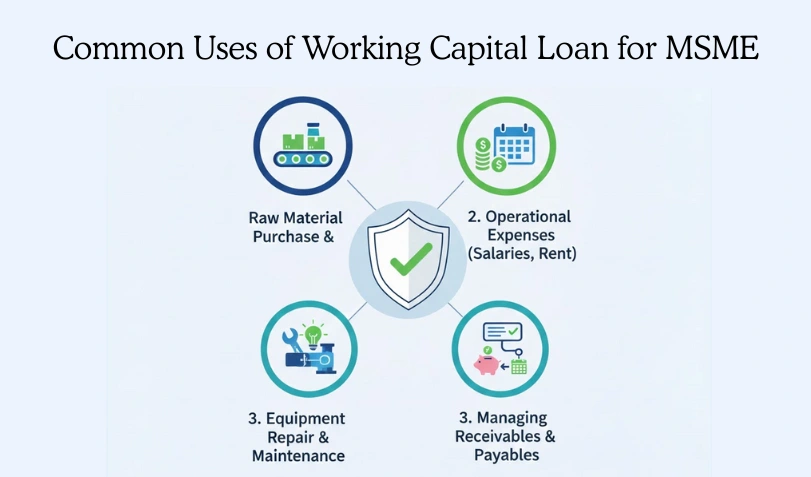

Common Uses of Working Capital Loan For MSME

A working capital loan for MSME is mainly used to handle daily business needs. It gives quick help when the business needs money to keep operations smooth. Here are some common and real examples of how MSMEs use this loan:

Buying Raw Materials : Manufacturers use an MSME working capital loan to buy raw materials on time, so production does not stop.

Paying Suppliers : Many businesses use the loan to pay suppliers quickly. This maintains trust and helps get better deals in the future.

Managing Salary and Staff Payments : During slow months or delayed customer payments, the loan helps pay salaries on time and keeps the team stable.

Stock and Inventory Purchase : Shops and traders use working capital finance for MSME to buy new stock, especially when demand suddenly increases.

Repair and Maintenance : Small repairs, machine servicing, or urgent maintenance can be done with this loan without disturbing the main budget.

Handling Customer Payment Delays : If customers take extra time to pay, a working capital loan for MSME fills the cash flow gap and helps the business run smoothly.

Daily Operating Expenses : Rent, electricity bills, transport, packaging, or other small expenses can be managed without any stress.

Working Capital Loan Interest Rates & Charges

The interest rate for a working capital loan for MSME depends on your business profile and cash flow. There is no fixed rate for everyone because each MSME has a different income pattern, documents, and repayment ability. Still, most MSMEs get simple and manageable rates that fit their short-term needs.

What Affects the Interest Rate?

1. Business Stability : If your business is running smoothly and has stable income, lenders may offer a better rate for your MSME working capital loan.

2. Bank Statements & Cash Flow : Clear and steady bank statements show that your business handles money well. This helps lower the cost of working capital finance for MSME.

3. Credit Score : A good credit score can help you get a lower interest rate. Even if the score is average, MSMEs still get approval if the business performance is good.

4. Loan Type (CC / OD / Short-Term Loan)

- Cash Credit and Overdraft may have flexible interest

- Short-term loans may have fixed rates.

- This depends on the lender’s rules and the amount you use.

5. Purpose of the Loan : If the money is used for essential operations like buying stock or paying suppliers, lenders often treat it as a safe use case.

Other Possible Charges : These extra charges may apply, depending on the lender:

- Processing fee

- Documentation fee

- Limit renewal fee (for CC/OD)

- Late payment charges

Everything is shared clearly with the business before approving the working capital loan for MSME, so there are no surprises later.

How to Apply Working Capital Loan for MSME

Applying for a working capital loan for MSME is simple. Most small and medium businesses can complete the process with basic documents and a clear idea of how much money they need. Here are the easy steps:

1. Check Your Eligibility : Make sure your business meets the basic rules for an MSME working capital loan. This includes business age, cash flow, and simple financial documents.

2. Collect Your Documents : Keep your ID proof, bank statements, GST returns, and business registration papers ready. Clear documents help you get faster approval for working capital finance for MSME.

3. Decide the Loan Type : Choose whether you need:

- Cash Credit (CC)

- Overdraft (OD)

- Short-term working capital loan

Pick the option that fits your daily needs.

4. Submit Your Application : You can apply online or offline. Online applications are faster and save time.

5. Verification by the Lender : The lender checks your documents, cash flow, turnover, and repayment ability. This step is simple if your bank statements are clear.

6. Approval and Limit Setup : Once approved, your cash credit limit, overdraft limit, or loan amount is set. You can then start using the money for daily business needs.

If you want simple guidance and clear information about MSME loans, you can visit msmeloaninindia.co.in.

The website explains loan options in easy language and helps businesses understand what type of working capital support they may need.

Working Capital Loan vs MSME Term Loan

Both loans are useful for MSMEs, but they serve different purposes. Understanding the difference helps a business choose the right option at the right time.

What Is a Working Capital Loan For : A working capital loan for MSME is made for daily business needs.

You can use it for:

- Buying raw materials

- Paying suppliers

- Managing salary and rent

- Handling customer payment delays

- Running day-to-day operations

It gives short-term support and helps maintain smooth cash flow.

What Is an MSME Term Loan For : A term loan is used for big and long-term plans.

Businesses use it for:

- Buying machinery

- Expansion or renovation

- Setting up a new unit

- Long projects that take time

It has fixed EMIs and a long repayment period.

Simple Comparison Table : Working Capital Loan vs MSME Term Loan

| Point | Working Capital Loan for MSME | MSME Term Loan |

|---|---|---|

| Purpose | Daily expenses, cash flow | Long-term growth, machinery, expansion |

| Type | Short-term | Long-term |

| Repayment | Depends on usage (CC/OD) | Fixed monthly EMIs |

| Use Case | Stock, bills, suppliers | Machines, renovation, new unit |

| Flexibility | Very flexible | Less flexible but stable |

Which One Should You Choose?

If your business needs money for daily operations, stock, or cash flow gaps, a working capital loan for MSME is the right choice. If your business needs funds for machines or expansion, then a term loan is better.

FAQs – Working Capital Loan for MSME

What is a working capital loan for MSME?

Who can apply for an MSME working capital loan?

What is the difference between CC and OD?

Is collateral required for an MSME working capital loan?

What documents are required?

How long does it take to get the loan?

What can I use this loan for?

Where can I get simple guidance for MSME loans?

Final Thoughts on Working capital loan for MSME

A working capital loan for MSME is one of the most helpful tools for managing daily business needs. It gives quick support when you need money for stock, supplier payments, salaries, or any small expense that keeps your business running. With flexible options like cash credit, overdraft, and short-term loans, an MSME working capital loan makes it easy for a business to handle cash flow gaps without stress.

This type of loan is perfect for small manufacturers, traders, shop owners, service providers, and seasonal businesses. It keeps the business active even when customer payments are delayed. With steady bank statements and basic documents, most MSMEs can get working capital finance for MSME and use it whenever they need it.

If you want to understand MSME loans in a simple and clear way, you can visit msmeloaninindia.co.in. The site explains different loan options in easy language and helps you find the right support for your business.

With the right working capital support, your MSME can grow smoothly and confidently every single day.

Apply For MSME Loan Now

Recent Posts

Contact Us

1204 GD – ITL Building, B- 08,

Netaji Subhash Place, Delhi-110034

Email: ceo@nkbkredit.com

Phone: +91 7503211000,

+91 9654981031

Important Links

Disclaimer

This website functions as a MSME-specific advisory channel supporting businesses seeking structured funding solutions. Advisory, documentation, and lender coordination services are provided by NKB Kredit Solutions Pvt. Ltd., a registered Indian company offering business finance advisory services.